Mining Is Booming. Hiring Still Isn’t. Here’s Why.

Introduction

Across Canada and the United States, mining sits in an unusual position. Long term demand for gold, copper, and critical minerals remains intact, supported by electrification, infrastructure investment, and energy transition policy (1), (2). Capital is being deployed and projects continue to move forward.

At the same time, hiring feels harder than it should. Candidates move smoothly through interviews only to hesitate late in the process. Employers adjust compensation, titles, and scope, yet acceptance rates remain unpredictable.

This is not because mining suddenly became unattractive. It is because recruitment decisions are now being made through a more cautious lens. Risk tolerance has changed, trust thresholds are higher, and both candidates and employers are responding to forces that sit outside traditional hiring logic.

What follows are five recruitment trends the market is quietly communicating right now.

Offers Are Being Decided at the Finish Line, Not the Shortlist

The most meaningful shift in recruitment is no longer sourcing or screening. It is what happens after a preferred candidate is identified. Executive search firms are reporting increased hesitation and fallout at offer stage, particularly for senior and specialist roles (3), (4).

Candidates are not disengaging early. They are progressing further, asking more detailed questions, and walking away when confidence erodes late. Research on decision making under uncertainty shows that people delay or decline high impact moves when risk feels poorly defined, even when upside exists (5).

This dynamic closely mirrors how candidate experience increasingly shapes offer stage outcomes, particularly when communication, role clarity, or leadership alignment feels inconsistent.

Role Definition and Stability Matter More Than Brand

Company reputation alone is no longer enough to close hires. Candidates are prioritizing clarity over brand recognition. They want to understand mandate, reporting lines, decision authority, funding certainty, and leadership tenure before committing (4), (6).

Leadership advisory research consistently shows that role ambiguity undermines confidence, especially in senior and technical positions where reputational risk is real. In mining, this is most visible in growth, integration, or transformation roles where expectations can shift mid process.

A clearly defined role at a lesser known organization is increasingly more attractive than a vague role at a global name.

Flexibility Has Become a Gating Factor, Not a Benefit

Flexibility is no longer a perk discussed late in the process. It is an early filter. Workforce research shows professionals across industries now assess roles based on schedule control, travel intensity, rotation design, and location expectations (7), (8).

This matters acutely in mining, where site presence and travel are often unavoidable. Candidates are not rejecting mining careers. They are rejecting structures that feel misaligned with sustainability at a personal or household level.

Employers who cannot clearly explain why rigidity is necessary are losing candidates to roles that offer even modest flexibility, regardless of headline compensation.

After Tax and Lifestyle Economics Are Replacing Headline Salary

Compensation discussions have become more granular. Candidates are no longer reacting to base salary alone. They are calculating after tax income, housing impact, childcare costs, commuting time, travel fatigue, and benefit quality.

Economic data shows household debt remains elevated and labor mobility has slowed across North America (9), (10), (11). In this environment, relocation or major role changes carry higher perceived downside. A higher salary can still result in lower quality of life once the full picture is considered.

This is why raising salary bands does not reliably improve acceptance rates. The constraint is not generosity. It is risk adjusted outcome.

Scarcity Is Shifting From Talent to Trust

The scarcest resource in recruitment today is not candidates. It is trust. Candidates are listening closely for consistency, transparency, and realism throughout the process.

Leadership and workforce research shows that in uncertain environments, credibility and follow through matter more than optimism or aggressive growth narratives (5), (12). In mining, where projects carry inherent execution risk, trust in leadership communication has become a decisive differentiator.

This is also why more organizations are turning to retained recruitment models for senior and critical mining hires, where trust and alignment matter as much as reach.

Why This Feels Particularly Acute in Mining

Mining sits at the intersection of strong long term demand and short term complexity. Industry data continues to support growth across gold, copper, and critical minerals (1), (2), (13). Yet hiring outcomes lag those signals.

Metals Prices Are Moving Faster Than Hiring Confidence

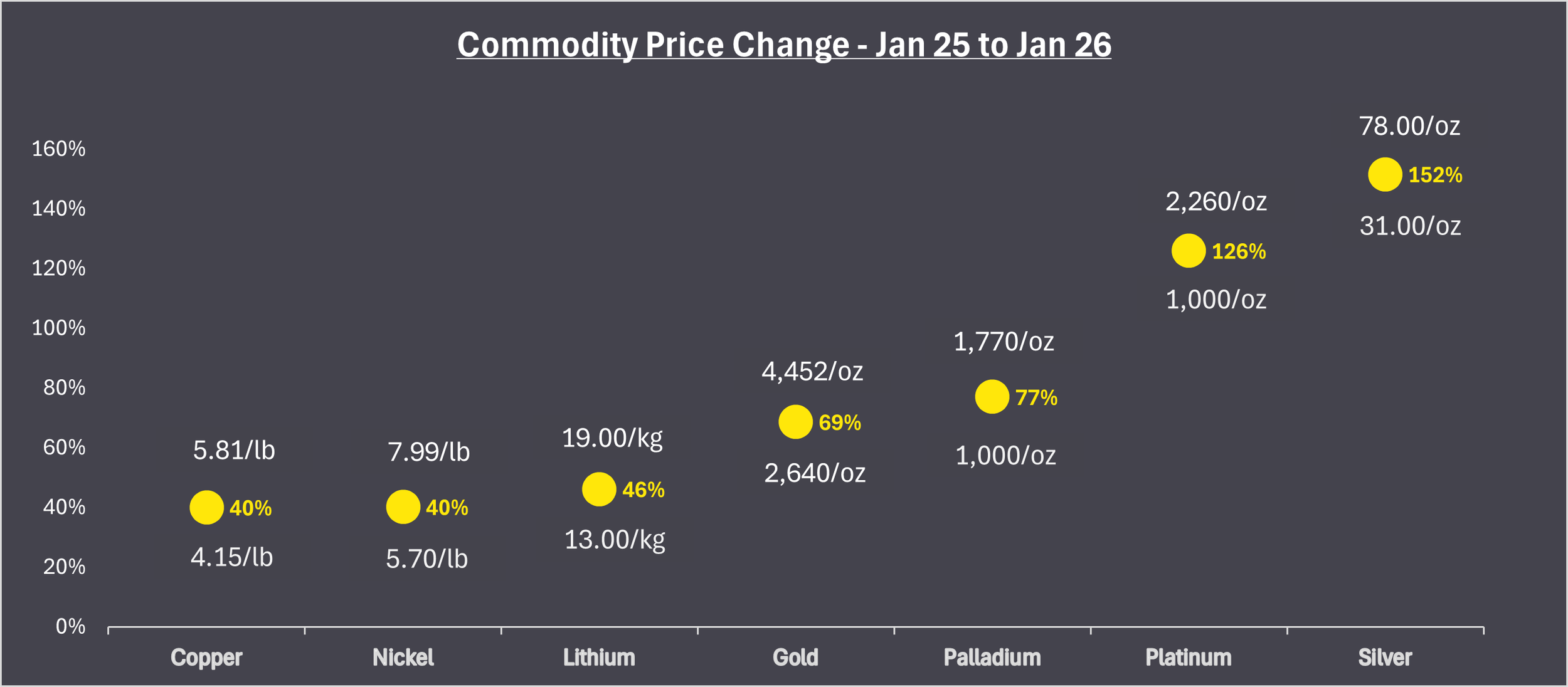

Selected Metal Prices: Year Over Year Percentage Change (Jan 2025 to Jan 2026)

Footnote: Percentage change used to normalise differing price units across metals.

After a weaker 2024, metals markets rebounded sharply through 2025 and into early 2026, with significant year over year gains across both base and precious metals central to Canada’s mining economy.

Copper, nickel, and lithium prices have risen materially compared to a year earlier, reflecting renewed demand tied to electrification, energy infrastructure, and tightening supply conditions. Precious metals have moved even more aggressively. Gold prices have surged on the back of geopolitical uncertainty and central bank demand, while silver, platinum, and palladium have posted outsized gains relative to recent historical averages (14), (15), (16).

These price signals point to improving project economics and stronger long term demand across multiple commodity groups. In theory, this should translate into greater investment confidence and an acceleration of project development across Canada.

In practice, hiring has not kept pace with price momentum. Mines still take years to permit, finance, and build. Companies remain cautious about committing to long dated labor decisions without certainty around infrastructure, regulatory timelines, and sustained demand. For candidates, stronger commodity prices do not automatically reduce career risk, particularly when roles involve relocation, project execution uncertainty, or long term capital exposure.

Strong commodity prices may unlock projects. They do not automatically unlock people.

A Market Signal Worth Listening To

These trends do not point to a broken hiring market. They point to a recalibrated one. Candidates are not disengaged. They are deliberate. Employers are not uncompetitive. They are operating in a higher trust threshold environment.

Organizations that adapt how they define roles, communicate risk, structure flexibility, and engage candidates late in the process will hire more effectively. Those that do not will continue to feel surprised by outcomes the market has already signaled.

References

Gold Demand Trends, World Gold Council.

Korn Ferry Talent Trends and Leadership Confidence Research.

Russell Reynolds Associates: Executive Transitions and Role Clarity Insights.

Decision Making Under Uncertainty, Harvard Business Review.

Spencer Stuart Leadership and Organizational Effectiveness Research.

Global Human Capital Trends, Deloitte.

Workforce Hopes and Fears Survey, PwC.

Household Debt and Economic Well Being, Federal Reserve.

Monetary Policy Report and Housing Market Analysis, Bank of Canada.

Labour Force Participation and Mobility Data, Statistics Canada.

Edelman Trust Barometer, Annual Global Report.

Mineral Commodity Summaries, United States Geological Survey.

Base Metals Market Outlook, London Metal Exchange.

Battery Metals Market Review, Benchmark Mineral Intelligence.

Precious Metals Market Trends, World Gold Council and Johnson Matthey.